As a landlord, protecting your asset is essential, but so is managing your financials. Finding the right landlord insurance that balances comprehensive coverage with cost-effectiveness can be a challenging task. With the best approach, however, you can secure a plan that meets your needs without financial strain.

In today's digital age, searching for cheap landlord insurance online offers a multitude of options. This article will provide you with valuable tips to navigate the insurance market smoothly. By understanding what to search for and how to compare policies, you can find a wallet-friendly solution that gives you peace of mind while safeguarding your investment.

Grasping Property Owner Coverage

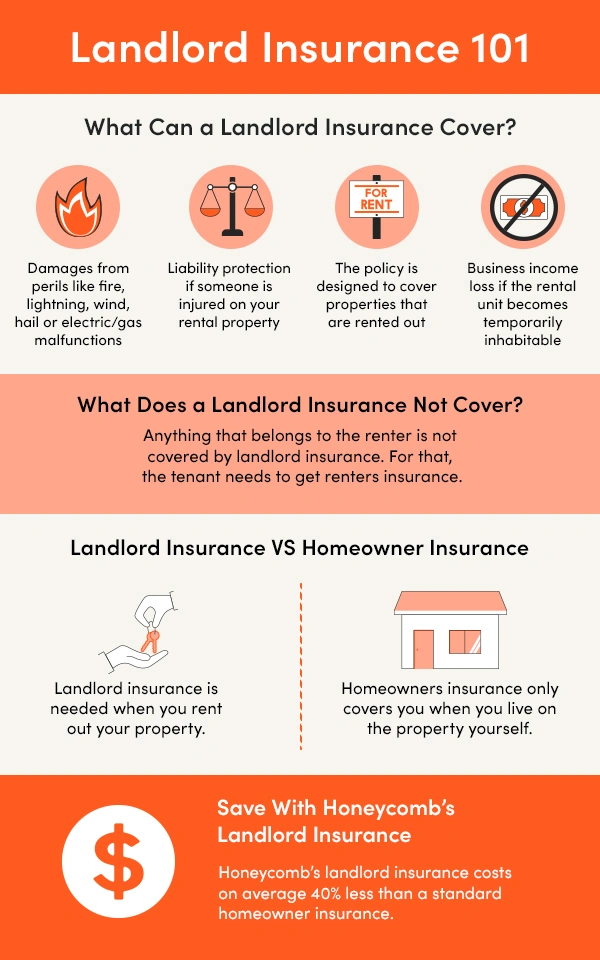

Rental property insurance is a specific type of insurance designed for landlords who lease their houses or additional real estate. Unlike typical homeowner coverage, landlord insurance tackles the unique hazards related to renting out properties. This encompasses coverage against property damage, liability issues from tenants or guests, and revenue loss from rentals due to unforeseen events like catastrophic events or tenant failures.

When you purchase rental property insurance, it typically covers certain risks such as damage to the building itself and the contents you own, such as furniture made available for renters' use. Liability protection is also crucial, protecting you against court cases that may arise from accidents occurring on your property. Comprehending the elements of this coverage can aid you make educated choices about what amounts of insurance you should consider.

Moreover, it's important to note that different rental property owners may have varying insurance needs based on the type of their rental unit they own, whether a one-unit property, a multi-unit building, or a vacation rental. Investing effort to assess your individual conditions and likelihood of risks can result in more economical and thorough coverage customized for your needs.

Factors Affecting Expenses

The cost of rental insurance can vary considerably based on various key elements. One of the main factors is the location of the rental property. Areas with higher crime rates or those prone to natural disasters often come with higher insurance premiums. Insurers take into account the hazards associated with specific regions, which can lead to a significant difference in expenses for landlords across various towns or communities.

Another critical factor is the type of property being insured. Detached homes typically have lower insurance rates than multi-family buildings, as the risk of multiple claims grows with the number of occupants. Additionally, the state and vintage of the property are significant; older buildings may require more upkeep and fixes, prompting insurers to charge higher premiums to cover potential issues.

The level of protection selected also impacts the cost of landlord insurance. how do I get cheap landlord insurance online can choose between basic policies that cover fundamental risks or more comprehensive plans that include additional protections, such as protection for decrease of rental income or responsibility protection. The more extensive the protection, the higher the premium, so it's essential for landlords to evaluate their specific needs and budget when choosing a policy.

Tips for Finding Cost-Effective Options

When search for landlord insurance on the internet, start by evaluating quotes from multiple insurers. Use quote comparison websites that allow you to enter your information a single time and get quotes from various providers. This not just saves time and also gives you a broader view of the market and may help spot competitive rates. Remember to seek out coverage that satisfies your individual needs, as the cheapest option may not always provide sufficient protection for your property.

A further way to reduce costs is to think about increasing your deductibles. Increased deductibles can result in lower premiums, which makes your insurance more affordable. Simply ensure that you choose a deductible amount that you can easily pay out of pocket if a claim occurs. Balancing your deductible and premium is crucial to securing the best deal that still offers sufficient coverage.

Finally, don't overlook discounts that may be accessible to you. Many insurance companies offer discounts for different reasons, such as combining policies, having multiple properties, or for claims-free records. Make sure to ask every provider about potential discounts while requesting quotes. Taking advantage of these savings can greatly lower your landlord insurance costs while still giving you the essential coverage.